As tax season looms, the quest for maximizing returns becomes a focal point for individuals and businesses alike. In this comprehensive exploration, we embark on a journey through the intricacies of tax planning and strategies, equipping you with the knowledge and confidence to navigate this annual financial milestone. Let’s delve into expert insights tailored to your unique circumstances.

Unveiling Deductions: Your Path to Maximizing Returns

The realm of tax deductions is rife with opportunities to optimize your returns. From business expenses to education-related costs, understanding the breadth of deductible items is key. We’ll guide you through the process, shedding light on often overlooked deductions that could make a significant difference in the final outcome of your tax return.

Leveraging Tax Credits: Putting Money Back in Your Pocket

Tax credits are powerful tools for reducing your overall tax liability. By delving into available credits, you can uncover opportunities to retain more of your hard-earned money. From education credits to energy-efficiency incentives, we’ll provide actionable insights into which credits align with your specific circumstances.

Strategic Planning for Long-term Gains

A forward-looking approach to tax planning extends beyond the current year. By evaluating potential tax implications of financial decisions, you can position yourself for long-term financial success. Whether it’s retirement planning or investment strategies, we’ll delve into the nuances of tax-efficient financial planning, empowering you to make informed choices.

Navigating Complexities: Expert Guidance for Business Owners

For entrepreneurs and business owners, tax season introduces a unique set of challenges and opportunities. From navigating business expenses to optimizing deductions, we’ll explore strategies tailored to the entrepreneurial landscape. With expert insights, you can approach tax season with confidence, ensuring that your business thrives financially.

Beyond Borders: International Considerations for Expatriates

For those navigating tax obligations across borders, the complexities can be daunting. We’ll provide a comprehensive overview of the tax implications for expatriates, offering guidance on compliance, deductions, and strategies for minimizing tax liability. With a clear roadmap, you can confidently manage your tax responsibilities regardless of your global footprint.

Expert Insights for Maximizing Returns

As tax season approaches, small business owners are presented with a crucial opportunity to strategically manage their finances and optimize returns. Here are key tips and tricks to help you make the most of this period:

1. Early Preparation Leads to Accurate Filing

To ensure a seamless and accurate tax filing process, planning ahead is paramount. By setting aside ample time, you can gather all necessary documents, such as financial statements, receipts, and invoices. This proactive approach reduces the risk of errors and potential penalties. Additionally, allocating funds specifically for taxes in advance helps you avoid last-minute financial hurdles, ensuring compliance with tax regulations.

2. Prioritize Timely Filing and Payment

Staying aware of tax deadlines is crucial for small business owners. Filing and paying taxes on time not only facilitates smooth business operations but also helps avoid penalties and legal issues. Regularly checking with the relevant tax authorities for updates ensures you stay informed about your tax filing obligations. Utilizing platforms like the IRAS myTax Portal provides easy access to essential resources and keeps you updated on important notifications.

3. Maintain Accurate Financial Records Year-Round

For business owners in Singapore, meticulous record-keeping throughout the year is imperative. This involves tracking income, expenses, and other financial documents relevant to small business tax preparation. By implementing a reliable system, such as accounting software, you can automate the tax process, enhancing efficiency and accuracy. This proactive approach optimizes financial processes, allowing you to focus on business growth.

4. Leverage Deductions and Incentives

Singapore offers various tax incentives and deductions to support business growth. These opportunities can significantly reduce tax liability and contribute to financial success. Understanding which incentives apply to your specific industry or activities is crucial. Whether it’s the Productivity & Innovation Credit (PIC) Scheme or R&D Tax Deductions, leveraging these options requires a comprehensive understanding of available reliefs and deductions.

Understanding Tax Laws and Deadlines

In South Africa, tax season follows a structured timeline with specific deadlines for filing returns. Familiarizing yourself with these crucial dates ensures you have ample time to gather necessary documents and seek expert advice if needed. Being aware of local tax laws and regulations is essential for accurate and compliant filings.

Capitalizing on Deductions Unique to South Africa

South Africa offers various deductions and incentives designed to encourage specific activities or investments. For example, the Section 12J tax incentive encourages investments in certain venture capital companies, providing a deduction for taxpayers. Additionally, donations to approved Public Benefit Organizations (PBOs) may qualify for deductions, contributing to both philanthropic efforts and potential tax benefits.

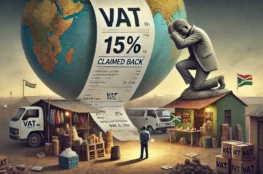

Navigating Tax Implications for Small Businesses

For South African small business owners, understanding tax implications is crucial. Value Added Tax (VAT) regulations, employment tax incentives, and Small Business Corporation tax rates are among the considerations that can significantly impact tax liabilities. By seeking expert insights tailored to the South African context, small business owners can make informed decisions that maximize returns.

Exploring Property-Related Tax Benefits

South Africa offers several property-related tax benefits, such as the Home Office Tax Deduction, which allows individuals who work from home to claim certain expenses related to their workspace. Additionally, individuals over the age of 55 may be eligible for a Capital Gains Tax (CGT) exclusion when selling their primary residence. Understanding and utilizing these benefits can lead to substantial tax savings.

Managing Retirement Contributions for Optimal Returns

Contributions to retirement funds in South Africa can have significant tax implications. Understanding the tax treatment of retirement contributions, including allowable deductions and tax-free thresholds, empowers individuals to make strategic decisions regarding their retirement savings. By leveraging expert insights, individuals can navigate this aspect of tax planning with confidence.

Maximizing Deductions: Proactive Planning

When it comes to tax deductions, proactive planning is key. Ensure you keep meticulous records of all eligible expenses throughout the year. This includes business expenses, charitable contributions, and any other deductible items. By maintaining a detailed record, you’ll be well-prepared to claim all the deductions you’re entitled to when tax season arrives.

Strategic Timing of Deductible Expenses

Consider the timing of your deductible expenses. For example, if you anticipate higher-than-usual medical expenses in the coming year, it may be beneficial to schedule necessary treatments or procedures before the end of the current tax year. This way, you can maximize your medical expense deduction for that year.

Invest Wisely for Tax-Efficient Returns

Make strategic investment choices to optimize your tax liability. Consider tax-advantaged accounts like IRAs or 401(k)s, which offer opportunities for tax-deferred growth. Additionally, explore investments with favorable tax treatment, such as long-term capital gains, which are often taxed at a lower rate compared to short-term gains.

Stay Informed: Updates in Tax Legislation

Tax laws and regulations are subject to change, and staying informed about updates is crucial for effective tax planning. Regularly consult reputable sources for updates on tax legislation. This could include official government websites, tax professionals, or trusted financial publications. Being aware of changes in tax laws allows you to adjust your financial strategies accordingly.

Engage with a Qualified Tax Professional

Seeking the expertise of a qualified tax professional can be invaluable. They can provide personalized advice tailored to your specific financial situation. A tax professional can help you navigate complex tax codes, identify additional deductions, and ensure accurate and compliant filings. Their insights can lead to significant savings and peace of mind during tax season.

Plan for the Future: Tax-Efficient Retirement Strategies

Consider long-term tax-efficient strategies, particularly for retirement. Evaluate options like Roth IRA conversions, which can provide tax-free withdrawals in retirement. Additionally, explore strategies for managing Required Minimum Distributions (RMDs) from retirement accounts, which can impact your taxable income in retirement.

From maximizing deductions to strategic investment choices, we’ve provided actionable insights tailored to your financial success. If you’re eager to delve even deeper into this topic or have specific questions in mind, I invite you to reach out through the contact form. Your inquiries and perspectives are invaluable, and together, we can ensure you approach tax season with utmost confidence and financial acumen.